The main purpose of the Undeposited Funds account is to make bank reconciliations easier. It does this by allowing you to group cash and paper checks into a single deposit, mirroring how banks process and deposit your payments. When reviewing your transactions, it’s easier to spot discrepancies and missing deposits since your QuickBooks records align with the combined deposits on your bank statement. Think of the record deposits function of you actually making the deposit at the bank. You are putting these funds into a specific bank account and you need to do the same thing in QuickBooks.

So, you need to combine your five separate US model subscription agreement $100 records in QuickBooks to match what your bank shows as one US $500 deposit. Some QuickBooks Online users prefer to post payments straight to their bank accounts rather than using the Undeposited Funds account. You must use the Undeposited Funds account only for payments that are physically collected, including cash and paper checks. If you’re depositing your checks one at a time, which is often the case for smaller businesses, you have to keep careful track of each and every deposit. However, when you use the undeposited funds account, you can record the specific checks in your software and not have to come back to them later to find out which is which.

How to Use Undeposited Funds in QuickBooks Online

Make sure you select Undeposited Funds from the “Deposit To” drop-down menu, then save the transaction. Your customer has given you a payment for goods purchased or services rendered. If your customer is paying an invoice you have entered into QuickBooks Online and sent to them, you will want to record the payment using the Receive Payments option. Let’s say your customer sent you a check for services rendered.

Instead, you can put the payment directly into an account and skip Undeposited Funds. When you follow the workflow to receive payment for an invoice, QuickBooks automatically puts them into Undeposited Funds. You can add payments to your deposit slip in a similar fashion.

Next Steps: Review your Undeposited Funds account

QuickBooks Online has a special account specifically for these funds in transit. Now you can select an Undeposited Funds or another account each time you create a sales receipt. If you need to delete a bank deposit, click the deposit or amount field in the Deposit Detail report and then click More at the lower part of the screen and then select Delete as shown below. Next, fill in the required information in the Receive payment form. To help you better understand how to complete the form, let’s use an example. Say we received a $1,700 check payment from Aaron Berhanu for a heating, ventilation, and air conditioning (HVAC) installation invoice.

- Additionally, you can add a description of the product or service, enter the quantity and rate, and add taxes if applicable.

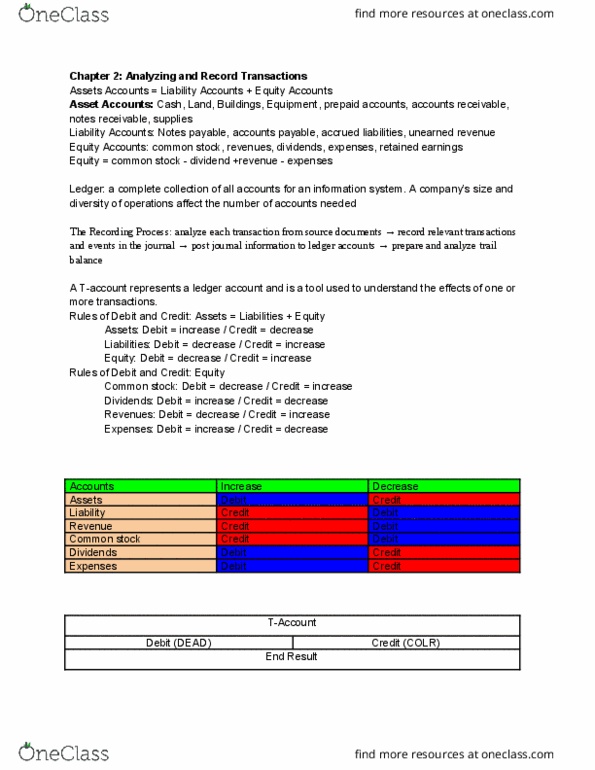

- Both accounts receivable and undeposited funds accounts were used but came out with a $0.00 balance in the end.

- So be sure to double-check that you properly complete the bank reconciliation to clear the balance.

- Select all the payments you will include in the deposit, making sure the amount you record in QuickBooks Online matches the amount on your bank deposit slip.

- It does this by allowing you to group cash and paper checks into a single deposit, mirroring how banks process and deposit your payments.

- FreshBooks is made with small business owners and freelancers in mind.

Adding a Payment to a Deposit

The reason is you have recorded the income when you created the invoice. You then would have most likely credited sales/income when you directly deposited the payment into QuickBooks. Follow the above procedures exactly and you should never have an issue. Should you run into any problems you know how to reach us. When it comes to keeping your finances vol ia sample executive compensation policy straight, QuickBooks does a brilliant job of providing simple yet effective tools to see the flow of money in and out of your company. Using features such as undeposited funds accounts means that you benefit from a more robust accounting system, with more checks and balances and a better understanding of where your money is at all times.

The payment will automatically go back to the Undeposited Funds account. Review your deposits to verify that the amounts recorded accurately what is an indirect cost definition reflect the total funds you deposited into your bank account. This will help catch errors and discrepancies and ensure a more efficient bank reconciliation.

Once done, click Save and close, and your received payment will automatically be reflected in the Undeposited Funds account. When you receive a paper check or cash for payment of an invoice, click on the + New button at the upper left portion of your QuickBooks Online dashboard and then select Receive payment, as shown below. Learn about the Undeposited Funds account and how to combine multiple payments together in QuickBooks. Now, when you check the Bank Register for your checking account, you can see the deposit posted for the correct amount. Continue entering payments received from your customers until all payments have been entered.